jersey city property tax phone number

Jersey City NJ 07302 Community Development 201 547-691059164747 9am - 5pm Mon - Fri 4 Jackson Square aka 39 Kearney Ave Jersey City NJ 07305. Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm.

New Jersey Residents Can Now Prepay Their Property Taxes 6abc Philadelphia

Automated Phone Numbers.

. If you need more information you may contact us at 609-989-3070. A-Z of States of Jersey departmental contacts. Remarkably it is estimated that the.

Property Taxes Payroll Tax Parking Permits Zoning Construction Code. Automated Phone Numbers. 2020-2022 Agendas Minutes and Ordinances.

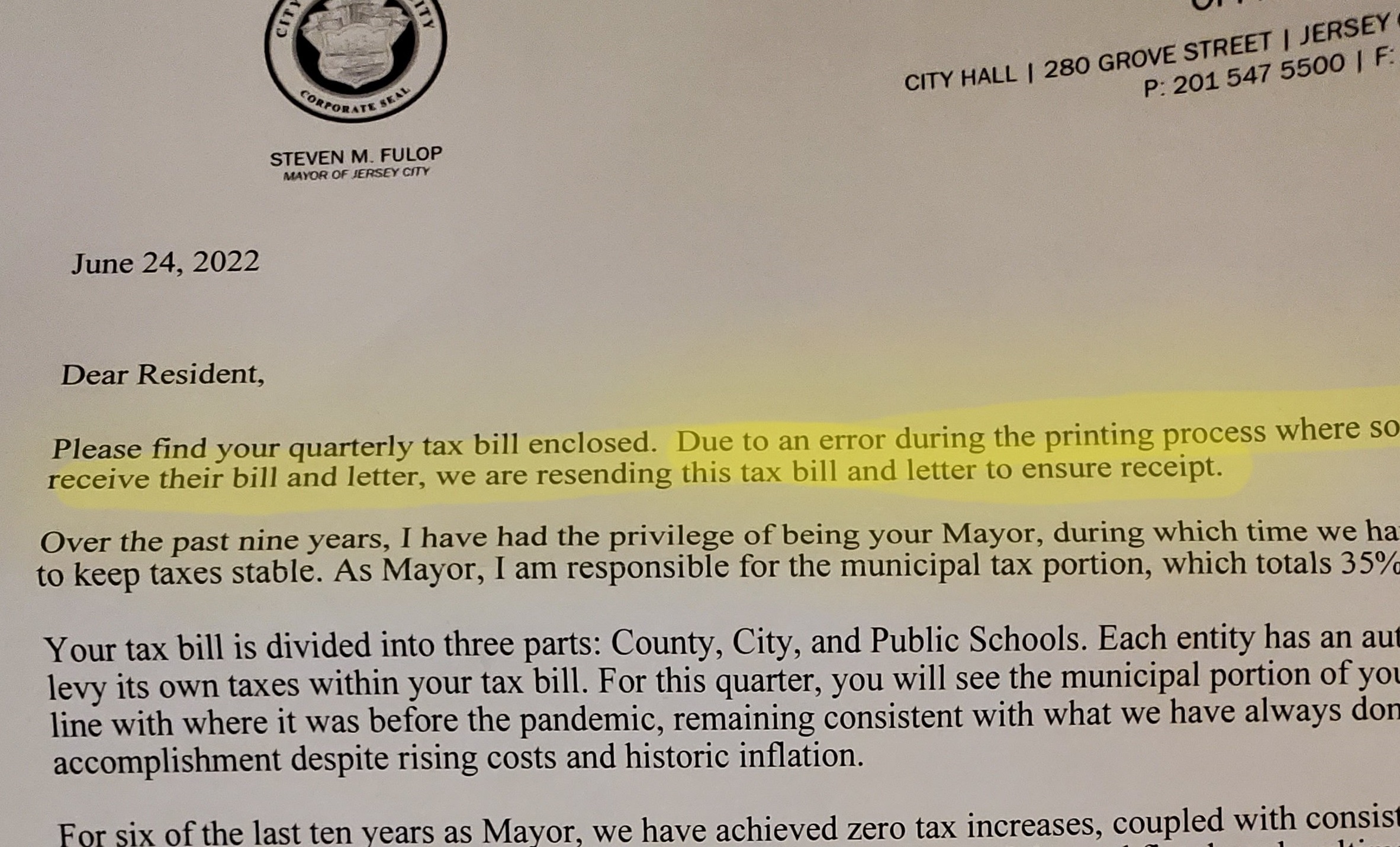

By Mail - Check or money. Since Mayor Fulop took office in 2013 Jersey City residents have seen stable taxes four years in a row alongside the expansion of public safety affordable housing public education social. 11 rows City of Jersey City.

Jersey City NJ 07302. Automated Phone Numbers. Office of the City.

When you contact the Division of Taxation through the. Online Inquiry Payment. 2019 Agendas Minutes.

In Person - The Tax Collectors office is open 830 am. Construction Code 201 547. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132.

The bills for 2022 February. Online Inquiry Payment. You can call the City of Newark Tax Assessors Office for assistance at 973-733-3950.

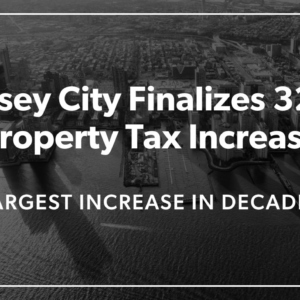

Jersey City has finalized the 2022 tax rate and it represents an unprecedented increase of 32 from its 2021 tax rate. Taxes for 2022 are due FEBRUARY 1ST MAY 1ST both with a 10 day grace period. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON.

It is official. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20. To view Jersey City Tax Rates and Ratios read more here. NJ Division of Taxation PO Box 900 Trenton NJ 08646.

HOW TO PAY PROPERTY TAXES. NJ Division of Taxation PO Box 900 Trenton NJ 08646. Please check your email address carefully before you send your message.

City of Jersey City. NJ Division of Taxation PO Box 900 Trenton NJ 08646. The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes.

TO VIEW PROPERTY TAX ASSESSMENTS.

New Jersey Extends Property Tax Deadlines Ke Andrews

New Jersey Education Aid Jersey City S Property Taxes Are State S Most Unfair Is Anyone Surprised

Jersey City Property Tax Appeal Archives Skoloff Wolfe P C

Jersey City S 2022 Tax Hikes Q3 And Q4 Tax Bill Flux Explained Civic Parent

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

Tax Assessor City Of Jersey City

City Clerk City Of Jersey City

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Pay Your Newark Property Taxes Online Or By Phone Councilman Anibal Ramos

Property Tax Relief R Jerseycity

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Jersey City Council Adopts 724 8 Million Budget

All That Glitters Isn T Gold New Jersey Policy Perspective

Jersey City To Refund Property Owners For Arts Tax Overcharge Jersey City Nj Patch

Average Nj Property Tax Bill Rose Again In 2020 Nj Spotlight News